The world of cryptocurrency has exploded in recent years, with Bitcoin and other cryptocurrencies gaining popularity and mainstream acceptance. As more people become interested in investing in cryptocurrency, it’s essential to understand the importance of risk management in crypto trading. Additionally, if you are new in the crypto world, you need to find a reliable and credible platform such as BITCOIN-BUYER.IO. Only in that way can you enjoy an immersive and secure trading experience.

Crypto trading can be incredibly lucrative, but it is also inherently risky. Cryptocurrencies are subject to extreme volatility, and the market can change rapidly, making it challenging to predict future trends accurately. Without proper risk management strategies in place, traders can easily lose money and put their investments at risk.

Effective risk management in crypto trading involves a range of strategies and techniques designed to minimize losses and protect investments. This can include diversifying portfolios, conducting technical and fundamental analysis, setting stop loss orders, and maintaining emotional control and discipline.

In this article, we will explore the importance of risk management in crypto trading and discuss strategies that traders can use to minimize losses and increase their chances of long-term profitability. By understanding the risks involved in crypto trading and implementing effective risk management strategies, traders can protect their investments and thrive in this exciting and rapidly evolving market.

Understanding Crypto Trading Risks

Crypto trading is risky and can be affected by a multitude of factors. These include market manipulation, cyber attacks, regulatory uncertainty, fraud, and sudden price fluctuations. Additionally, due to the decentralized nature of cryptocurrencies, there is a lack of oversight and regulation, which can also increase the risk of scams and fraud. Understanding the risks is important because traders can take steps to mitigate them and protect their investments. This can include conducting thorough research on the cryptocurrency and exchange before investing, keeping up to date with market news and developments, and implementing effective risk management strategies.

The Importance of Risk Management

Effective risk management is crucial for success in crypto trading. Without it, traders are at the mercy of the volatile crypto market and can suffer significant losses. However, with risk management strategies, traders can reduce their exposure to market volatility, minimize losses, and increase the likelihood of long-term profitability. This applies to diversifying their portfolio, setting clear trading goals and limits, using technical and fundamental analysis, and maintaining emotional control and discipline.

Setting Trading Goals and Limits

Setting clear trading goals and limits is essential for successful risk management in crypto trading. Traders must define their objectives and the desired outcome of each trade. They must also set limits on the maximum loss they are willing to take on a single trade. By doing this, traders can reduce the impact of market volatility and prevent significant losses. Additionally, setting clear goals can help traders stay focused and avoid making impulsive decisions based on emotions.

Diversification of Crypto Portfolio

Diversification is a risk management strategy that involves investing in a variety of cryptocurrencies. By spreading the risk across multiple cryptocurrencies, traders can reduce their exposure to market volatility on a single cryptocurrency. Diversification also allows traders to take advantage of opportunities in different sectors of the cryptocurrency market, further reducing risk. Additionally, diversification can provide a hedge against the potential failure of a single cryptocurrency or exchange.

Technical Analysis and Trading Tools

Technical analysis is a risk management tool that involves using charts and trading tools to analyze market data and identify patterns and trends. With those technical analyses and trading tools, traders can reduce the impact of market volatility and make more informed trading decisions. The good news is that this can lead to more profitable trades and less exposure to risk. Additionally, technical analysis can help traders identify entry and exit points for trades, as well as provide insight into the overall trend of the market.

Fundamental Analysis and Market News

Fundamental analysis involves analyzing the underlying factors that affect the value of a cryptocurrency, such as the technology behind it, the market demand, and the competition. Keeping up with market news and developments is also essential in making informed trading decisions. Traders can reduce the impact of market volatility and make more informed trading decisions when they use fundamental analysis and market news. Additionally, fundamental analysis can help traders identify potentially undervalued or overvalued cryptocurrencies.

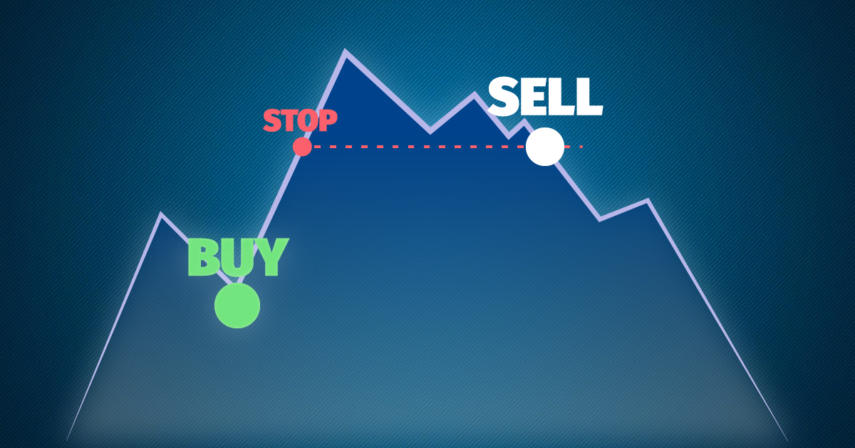

Stop Loss Orders

Stop-loss orders are a crucial risk management tool that helps traders minimize losses by automatically closing a trade when the price of a cryptocurrency reaches a predetermined level. This helps traders to limit their losses and prevent significant losses. Besides, stop loss orders can be used in combination with other risk management strategies, such as diversification and technical analysis, to further reduce risk. Additionally, stop-loss orders can help traders maintain emotional control by automatically closing a trade when the price reaches a certain level rather than allowing emotions to dictate their decisions.

Risk-Reward Ratio

The risk-reward ratio is a critical aspect of risk management in crypto trading. It is the ratio of the potential profit to the potential loss of a trade. A good risk-reward ratio ensures that the potential reward outweighs the potential loss of a trade, making it a viable option. Traders should aim for a risk-reward ratio of at least 2:1, meaning the potential profit should be at least twice the potential loss. When a trader maintains a good risk-reward ratio, he can reduce the exposure to risk and increase the chances of long-term profitability.

Emotional Control and Discipline

Emotional control and discipline are essential for successful risk management in crypto trading. Emotions such as fear or greed can cloud a trader’s judgment and lead to impulsive decisions. By maintaining emotional control and discipline, traders can avoid making irrational decisions and reduce their exposure to risk. It is crucial to stick to a trading plan, set clear trading goals and limits, and avoid making decisions based on emotions.

Continuous Education and Learning

Continuous education and learning are crucial for effective risk management in crypto trading. The cryptocurrency market is constantly evolving, and new risks and opportunities arise all the time. Traders must stay informed about market news and developments, as well as continuously learn new trading strategies and techniques.